Commodity-based economies, Sub-Saharan African (SSA) economies are heavily reliant on commodities.

According to a 2016 report from the United Nations, Central and Western African exports are comprised 97% and 94% respectively of commodities, followed by Eastern and Southern Africa on 80% and 58%.. So it’s unsurprising that commodities-related transactions attract most of SSA financing.

In need of critical infrastructure

Infrastructure financing has grown as better infrastructure has become a priority in driving industrialisation and economic growth.

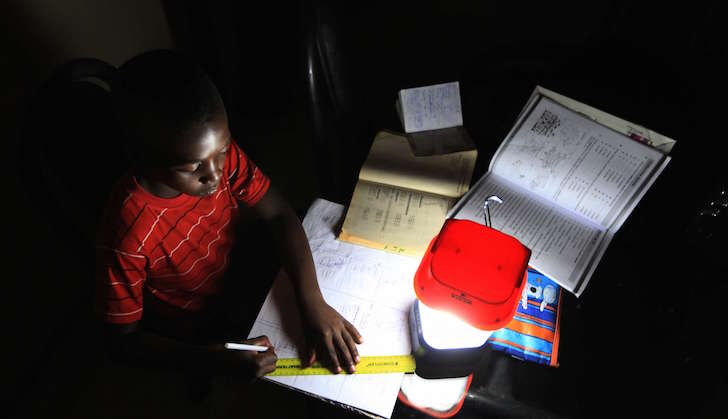

The scale of investments needed to keep SSA afloat is staggering. According to the African Development Bank (AfDB), 45 African countries out of 54 have neither the capacity nor the quality of infrastructure to drive their economic development. An estimated $130bn-$170bn of investments are required per annum to close the gap by 2025.

Boom . . . and bust

The commodity market boom from end of 2010 to early 2014 boosted project finance transactions.

Falling commodity prices from the end of 2014 resulted in retrenchment by commercial banks, and lower annual volumes and revenues for countries, leading to a deterioration of sovereign credit ratings. This also affected African budget allocations to infrastructure.

The growing catalytic role of DFIs in infrastructure projects

This new reality triggered a need to re-think the prevailing approach to commercial debt for SSA infrastructure transactions. Development Finance Institutions (DFIs) have led the way, proposing financial instruments to incentivise promoters or debt providers.

Some DFIs are providing financial and technical assistance for project feasibility studies (for example, PDIG Group via TAF company and AfDB via the NEPAD – IPPF facility). They provide irrevocable guarantees which can be called on demand by lenders (for example PDIG Group via the GuarantCo company) which can allow pension funds to access strategic infrastructure assets.

In parallel, key programs were launched to tackle specific sectors, such as the Scaling Solar Program from the International Finance Corporation (IFC) and Get-Fit in Zambia, which support on-grid renewable power projects.

The resurrection of SSA: challenges and opportunities for 2019

The revival in commodity markets in 2017-2018 enabled the creation of a robust pipeline in upstream and downstream oil and gas transactions, with some dormant mining opportunities being revived. Many large infrastructure projects progressed and are nearing financial close.

Challenges are likely with an unpredictable commodity market and 10 major elections in the region scheduled this year, including Nigeria and South Africa. Political uncertainty can deter investors. There are also concerns regarding debt sustainability in countries such as Kenya and Zambia.

The increasing involvement of the Chinese government in providing bilateral loans has triggered a reaction from the US, seeking to counter China’s extending influence. This could represent an opportunity for the region as the US revamps its international finance contribution with the BUILD Act.

The US International Development Finance Corporation (USDFC) expects to double the Overseas Private Investment Corporation (OPIC) investment limit to $60bn. The USDFC can also take equity positions, provide technical assistance and finance feasibility studies.

From a transaction perspective, the region is a commodity warehouse and a construction site thirsting for project finance. We therefore expect progress in regional transactions.

The $2.5bn Nigeria LNG new train financing and the $2bn National Nigeria Petroleum Company (NNPC) refineries projects in West Africa merit close attention.

In East Africa, watch the $3.5bn export pipeline between Uganda and Tanzania. In southern Africa, a final investment decision for the $14.5bn Area 1 LNG project in Mozambique is set for the first half of 2019. We are also monitoring the implementation of the Scaling Solar Program and Get-Fit initiative led by IFC and the German DFI, KfW.

The conclusion of key sizeable transactions is approaching and the prospect of healthy competition between China and US to provide affordable infrastructure financing will benefit the SSA region.